Brunei is accelerating the development and implementation of policies to increase the competitiveness of its small and medium enterprises (SMEs) to diversify the economy amidst lower oil and gas prices, according to the 2018 ASEAN SME Policy Index (ASPI) by the Organisation for Economic Co-operation and Development (OECD).

The report, which monitors and evaluates progress in policies that support SMEs in emerging economies, noted that the Sultanate is still in the early phase of developing SME policies but is advancing rapidly.

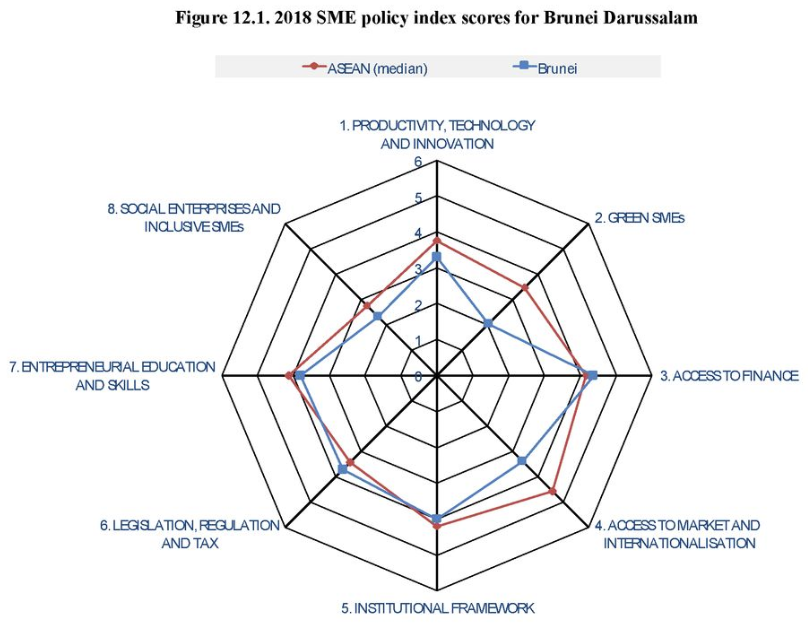

Under the eight dimensions of policy measured, Brunei is ahead of the ASEAN median in providing SMEs access to finance and favourable legislation, regulation and tax. However, the Sultanate lags behind in six other dimensions: green SMEs, institutional framework, social enterprises and inclusive SMEs, access to market and internationalisation, entrepreneurial education and skills and productivity, technology and innovation.

Much of the improvements in the institutional and regulatory environment for businesses comes after the establishment of a statutory body for local enterprises Darussalam Enterprise (DARe) which consolidated national measures to develop SMEs and the Ministry of Energy, Manpower and Industry’s (MEMI) initiative to set up the Ease of Doing Business Steering Committee which has driven Brunei’s rise from 105th to 55th in the World Bank’s doing business rankings.

The focus in improving the ease of doing business rankings – which measures 10 indicators affecting a business’ lifecycle – has lead to reductions in the average time needed to start a business from 104.5 days to 12.5 days. The legal framework for getting credit has also greatly improved through wider credit registry coverage and the enabling of movable assets as collateral.

ASPI recommends that Brunei develop an official definition for micro, small and medium enterprises (MSMEs). Relative to other OECD countries, Brunei’s current MSME guideline by the Department of Economic Planning and Development (JPKE) of micro as one to four employees, small as six to 19 employees and medium from 20 to 99 employees may be potentially limiting.

“The upper threshold for classification as a medium-sized enterprise is relatively low… potentially excluding some enterprises that would normally be classified as an SME from development policies and programmes,” it said.

A specific policy for SMEs to leverage on global value chains is also recommended which would provide financial assistance and business linking with larger local enterprises that export or multi-national companies.

ASPI added that a survey should also be conducted to measure the willingness of banks to lend to MSMEs, since there are few targeted programmes for them. However as ASPI’s 2018 assessment was carried out in 2016 to 2017, the report did not factor the more recent establishment of an MSME-focused financial institution Bank Usahawan.

The report also recommended that the government should collaborate more extensively with the private sector and learning institutions in formulating and implementing SME development programmes that can reach different industries and demographics.

DARe’s CEO Javed Ahmad said the report would be useful as a review of current MSME policies as they move to coordinate efforts to improve or create more effective policies.

“With ASPI 2018, I believe it will make things a lot easier as it has provided us with some useful assessments from which we can focus on specific areas for improvements and prioritise our efforts,” he said during the opening of the dissemination seminar.